On-The-Chain - April 28, 2019 - Q&A w/ Greg Rigano of IKU Network

Fiat-Collateralized Stablecoins See Uptick, MakerDAO Stability Fee In Review, Cosmos Enables Transfers In Historic Fashion, ATH of $12.6M of ETH Locked In Dharma, & More

Welcome to On-The-Chain, a focused look at the most interesting data, networks, and people pertaining to the chain and crypto economics.

This issue features a Q&A with Gregory Rigano of IKU.

Fiat-Collateralized Stablecoins See Uptick

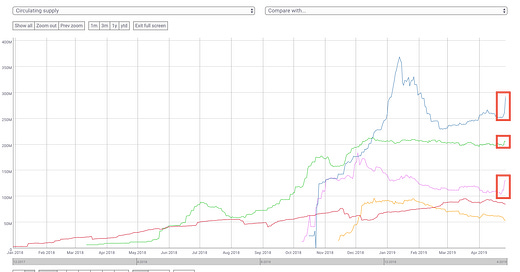

Fiat-collateralized stablecoins like Circle and Coinbase’s USD Coin, TrueUSD, and the Paxos Standard have all seen upticks in circulating supply since the recent Tether / Bitfinex kerfuffle on April 25th.

The data above is from https://coinmetrics.io/charts/.

USDC, TUSD, and PAX respectively saw increases of 14.6%, 3.5%, and 17.4% in circulating supply.

The Takeaway: The Tether / Bitfinex situation has and continues to be opaque.

MakerDAO Stability Fee In Review

MakerDAO has aggressively raised the stability fee over the past few weeks.

The data above is from https://vic007207.github.io/crypto_data/.

The Takeaway: Maker is learning as it goes. I am excited for MCD.

Cosmos Enables Transfers In Historic Fashion

Cosmos recently enabled Atom transfers, as the 99 validators voted favorably on an on-chain proposal to do so. Below is an outline of the five Cosmos Hub-1 proposals.

The data above is from http://bit.ly/AtomTransfersEnabled.

Transferability has prompted multiple exchange listings including Huobi, Kraken, Poloniex, and a now an announcement from CZ.

The Takeaway: While I am excited about initiation of phase II of the mainnet, it is phase III and Inter-Blockchain Communication when Cosmos will be in its prime.

ATH of $12.6M of ETH Locked In Dharma

Since launching on April 8, Dharma Labs has facilitated more than $6.4 million worth of crypto loans. There is currently $12.6M of ETH locked in Dharma smart contracts!

In a recent CoinDesk piece, Dharma Labs business development manager Max Bronstein told the publication,

“As DAI slips under a dollar, trading at like $0.97, people can actually go buy DAI and lend it on Dharma for 11 percent annual [interest] rate.”

Dharma investor Arianna Simpson noted some folks are using the loans to lever up on ETH or refinance their CDPs and added,

“Having a product that doesn’t require you to use MetaMask and just works is pretty awesome.”

The DeFi upstart plans to add support for Bitcoin and fiat-collateralized stablecoins.

Visit the Dharma website to learn more and get started.

The Takeaway: It is still earn days for DeFi / open finance, but Dharma is one of the companies pioneering the way to an open financial system.

Uniswap Raises $1M+ From Paradigm

Congrats Hayden, Dan, and the rest of the Uniswap and Paradigm teams.

The Takeaway: I am excited to watch Uniswap grow and continue on it’s prolific journey.

Aragon Network Vote #2 Results

AGP-9: The Separation of Church, State, and Network

Yes: 41.91%

No: 58.09%)

Status: Rejected

AGP-28: Decentralizing aragonpm.eth

Yes: 100%

No: 0%

Status: Approved

AGP-34: Flock Funding for Aragon Black

Yes: 99.49%

No: 0.51%

Status: Approved

AGP-35: Edgeware Lockdrop Participation

Yes: 71.85%

No: 28.15%

Status: Approved

AGP-37: Retainer for Ongoing Aragon Network Security Provider

Yes: 35.36%

No: 64.64%

Status: Rejected

AGP-40: Aragon Cooperative DAO funding proposal

Yes: 86.26%

No: 13.74%

Status: Approved

AGP-41: Aragon Portfolio Diversification - Acquisition of DOTs

Yes: 7.71%

No: 92.29%

Status: Rejected

AGP-42: Keep Aragon Focused on Ethereum, not Polkadot

Yes: 31.29%

No: 68.71%

Status: Rejected

AGP-43: ANSP Engagement Policy

Yes: 93.21%

No: 6.79%

Status: Approved

You can see the final results from Aragon Network Vote #2 as recorded on the blockchain in the Voting app here.

The Takeaway: Aragon is at the forefront of crypto governance.

DeFi NYC x Blockchain Week NYC

We will soon be announcing several blockchain week DeFi NYC events with some of the most innovative companies building open financial products.

Join the DeFi NYC Meetup group for announcements and to be part of one of the most vibrant communities in crypto.

I have also put together a Telegram group for those interested.

Q&A with Gregory Rigano, Founder of IKU

Gregory Rigano is the Founder & CEO of IKU, an Advisor to the Stanford SPARK program, pediatric oncology survivor, drug developer, investor, lawyer, and student of blockchains.

Q: How do you see blockchain accelerating biotech research and development?

A: The inspiration is Sci_hub – in which all research is open source and free for educational purposes. But the key issue is how do we economically align around this to scale research communication amongst stakeholders – essentially unlocking Metcalfe’s law1 for biomedical research.

It’s all about economic incentives. Historically, patents were that economic incentive but this has generally resulted in information secrecy, $30 billion a year in litigation (U.S.) and 95% of medical conditions without effective treatments (source: 21st Century Cures Act).

According to Ray Dalio, arguably the most successful hedge fund manager of all time, the most efficient economies have the most transactions of value (velocity of money). The velocity of patents = 0.

The current way of monetizing research is indirect:

Discovery -> Patent -> Company acquires patent -> sell equity in company -> money

This is generally unscalable to the science community as the incentives generally only accrue to the executives and shareholders - resulting in market failure as described above. We must put science back in the hands of scientists in a scalable way, similar to how Github has done this for software developers.

Enter blockchains.

Blockchains have the ability to directly monetize biomedical research through proof of existence in which the research = money.

How? Blockchains are publicly verifiable copyright machines. Copyright is a form of intellectual property, but it is an objective standard across the globe – putting unique information (e.g. bitcoin bitstring) in a tangible medium (e.g. github) and publishing it (proof of existence validation) as opposed to patents which are a subjective standard and can be invalidated. In addition, a party must own the copyright to research and be the first to publish in order to obtain a patent on it.

But you say damn the copyright, all information should be free! Copyright has many different rights attached to it – e.g. All Rights Reserved. This includes publishing, commercialization, research rights etc. There is nothing stopping a decentralized research organization (“DRO”) from open-sourcing the research freely for educational purposes (<3 Sci_hub) and then requiring a license for commercial purposes. Notably, Sci_hub's great competitor, Elsevier makes $3 billion a year and growing, even though everything they publish is freely available on Sci_hub – why is that?

Analogize it to Spotify – you, the human, can listen to a song in your home for free, but if Disney, the corporation, wants to put the song in a motion picture, they must negotiate a commercial license.

Historically, intellectual property has been non-fungible. For the first time, blockchains enable intellectual property to become fungible through tokenized intellectual property ownership as well as prove their chain of title in trade using a blockchain for enforcement as opposed to courts, judges and lawyers. This eliminates significant inefficiencies from the legacy system and exponentially increases velocity.

In this case, the tokenized intellectual property ownership would be a research license. This architecture enables a DRO to become a cybernetic collective of people and machines plugged in as nodes on a network, fueling innovation and owning the value – with aligned incentives as anyone with internet access can have skin in the game. The more unique research that is aggregated in the DRO, the more valuable the research license aka tokens become.

Q: Walk us through the IKU proposal

A: Anyone with internet access may submit a research target, which can be as broad or specific as desired. In order to submit a proposal (one level up from research target), one MUST hold at least 1 IKU token in their wallet. A proposal MUST include research justification, stage of research and funding sought. If a proposal receives a certain threshold of upvotes, it will proceed to a public auction in which the research itself becomes tokenized as a commoditized intellectual property license thereby launching a DRO around the research. Whoever participates in the auction thereby owns fungible research license and may participate in the DRO to advance it to the market. Any third party that wants to license the research must do so through the token market.

Q: Are there any biotech sub-verticals you are especially keen on?

A: Its important to not look at conditions as we have been trained to – based on their anatomical location. Instead, look at conditions by biomarkers - a way to quantifiably measure presence of a condition. This enables detection of root causes and crossovers between diseases that we previously thought were different.

This strategy has been heavily influenced by our research relationships with Stanford SPARK and the Structural Genomics Consortium at Oxford, as well as 3 research by Professor Andrew Lo at MIT. The IKU pipeline will always be based on biomarkers and quantifying underlying causes of disease as opposed to the traditional pharma model of classifying conditions by anatomical location. This enables mass efficiency both scientifically and economically. When a biomarker is known and quantified, measures can be developed across multiple disease spectrums by mapping that biomarker against all the published research that has been completed to date. This then enables for development of supplements and rediscovering old drugs to successfully modulate the biomarker – typical cost is under $3 million to prove in human trials – low cost at scale.

Q: What could be the first mainstream blockchain healthcare application?

A: Money. Biomedical research information is the most important information in the world - unquantifiable value to all humans, regardless of socio-economic background. Blockchains enable it to be directly monetized through proof of existence. If a bitcoin is property ownership of a random bit string of data, why can’t we replace that bit string with the most advanced biomedical research data in the world?

Q: How can the community get involved?

A: We’re launching the first decentralized research organization (“DRO") this year based around a new biomarker called “plasmalogen” with the goal of stopping Alzheimer’s disease. This is a breakthrough in neuroscience and the DRO will be led by eminent scientists with research supported by major institutions including the U.S. National Institute of Health, National Institute on Aging, University of Pennsylvania, Prodrome Sciences, and the Alzheimer’s Association. The DRO will be tokenized as stated above. We expect it to have significant implications on neuro-degeneration, dementia, Parkinson’s, multiple sclerosis and aging generally. Visit alz.iku.network for more info on the DRO. If you have questions, comments etc. join the Telegram or feel free to email me at Gregor@iku.network.

Feel free to reach out to me on Twitter (@ColeGotTweets), Telegram (@colekennelly), WeChat (@colekennelly), or find time to connect here.

A special thank you to Gregor & IKU!

Nothing in this email is intended to serve as financial advice. Do your own research.

Ξ: 0x531BCcD06875a734447f7c6AFf810f775fc6188c

₿: bc1qcaahhtk42x6hpl0flunkyttx7mwtmnuklksfpu