On-The-Chain - January 21, 2019 - Q&A w/ Alex Adelman of Lolli

Uniswap Locks Up ~21% More ETH, Veil Joins Top Relayers, Upcoming Aragon Governance Proposal Vote, & Q&A with Alex Adelman of Lolli

Welcome to On-The-Chain, a focused look at the most interesting data, networks, and people pertaining to the chain and crypto economics.

This issue features a Q&A with Alex Adelman, CEO & Co-founder of Lolli.

Uniswap Locks Up ~21% More ETH

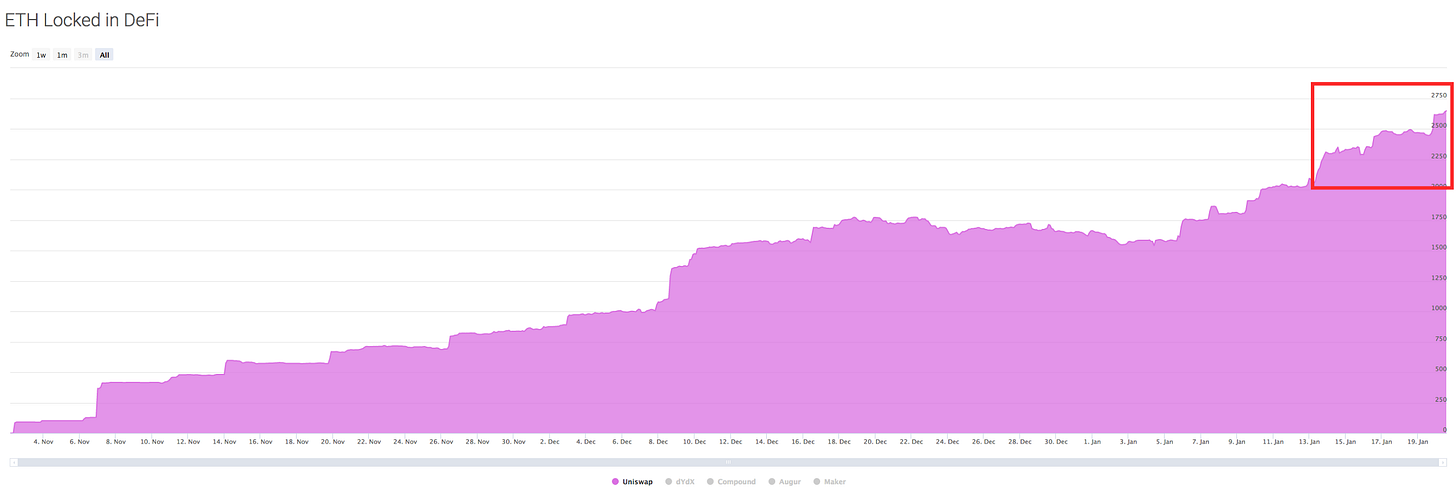

Uniswap is an entirely on-chain exchange protocol that utilizes an automated market maker (AMM). In the past week, Uniswap has seen a 21.42% increase in ETH locked up on its platform, bringing the total ETH to over 2,600 ETH. Over $1 million was traded on Uniswap in the first two months of its existence.

The chart above is from https://mikemcdonald.github.io/eth-defi/.

Uniswap was originally inspired by some comments from Vitalik Buterin in 2016. Ultimately, Uniswap makes use of a Constant Product Market Maker, a type of AMM. The secret to the Constant Product Market Maker is the formula x * y = k, where x and y are the coin quantities in the liquidity pool, and k is the product. There is an equivalent amount of ETH and ERC20 tokens locked up on the platform. In other words, if there is 2,600 ETH locked up on Uniswap then there is also 2,600 ETH worth of ERC20s locked up.

There are two parties that interact with Uniswap: traders and liquidity providers. For traders, Uniswap is an option for fast and easy access to tokens built on Ethereum. In the case of liquidity providers, a 0.3% fee is earned on all trading volume. Fees are distributed to liquidity providers based on the percentage of the liquidity pool they provide. These fees are automatically put back into the pool, but are able to be collected whenever.

The Takeaway: There is clear demand for fully decentralized, on-chain DEXs with simple designs and good UX. Uniswap is a brilliant project and should continue to grow with the Ethereum ecosystem. Liquidity fees are a unique opportunity for folks with idle crypto to earn passive income.

Veil Joins Top Relayers

Veil is a recently launched peer-to-peer prediction market and derivatives platform built on top of Augur, 0x, and Ethereum. Veil is only available in certain jurisdictions, given the nebulous and restrictive regulations of certain countries including the United States.

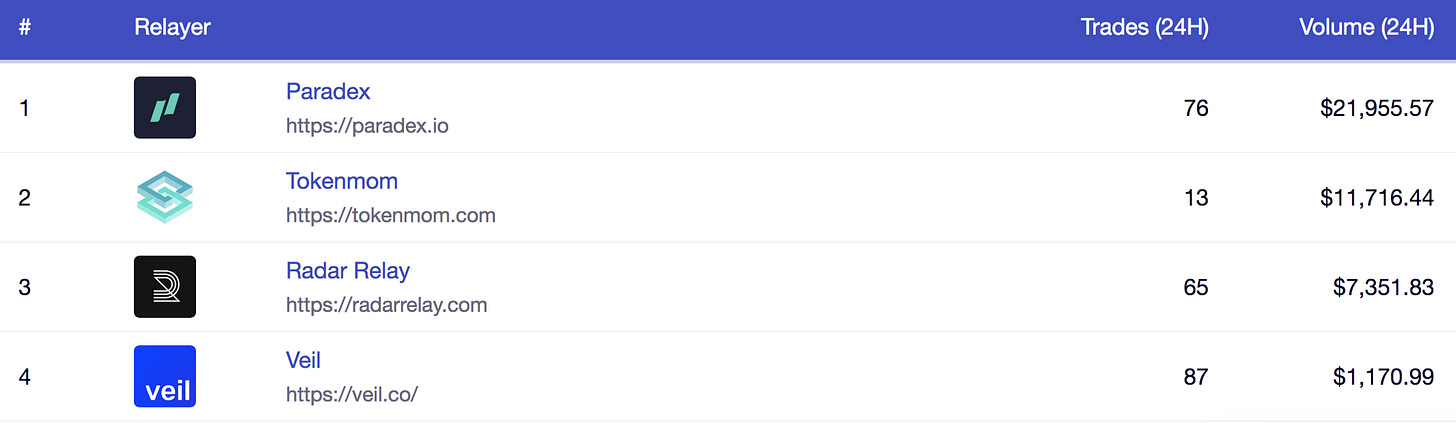

After launching on January 15th, 2019, Veil has emerged on the 0x Tracker relayer leaderboard as the fourth-ranked relayer in terms in 24 hour volume and the first-ranked relayer in terms of trades.

The date above is from https://0xtracker.com/.

Veil features a UI designed for quick and easy trading (Veil), an exchange-like UI for advanced traders (Veil Pro), and a REST API for algorithmic traders (Veil API).

The Takeaway: Startups incepted in similar fashion to Veil will continue to be prominent in our industry. A protocol, such as Augur, is created. A centralized entity, such as Veil International, builds on said protocol and makes it much more usable and beneficial to end users.

Upcoming Aragon Governance Proposal Vote

In November 2018, Aragon Network held a community vote to approve AGP-1, the Aragon Governance Proposal (AGP) process. An Aragon Governance Proposal is a “document that details a change to the management, allocation, or use of shared resources owned or directly influenced by the Aragon Network.”

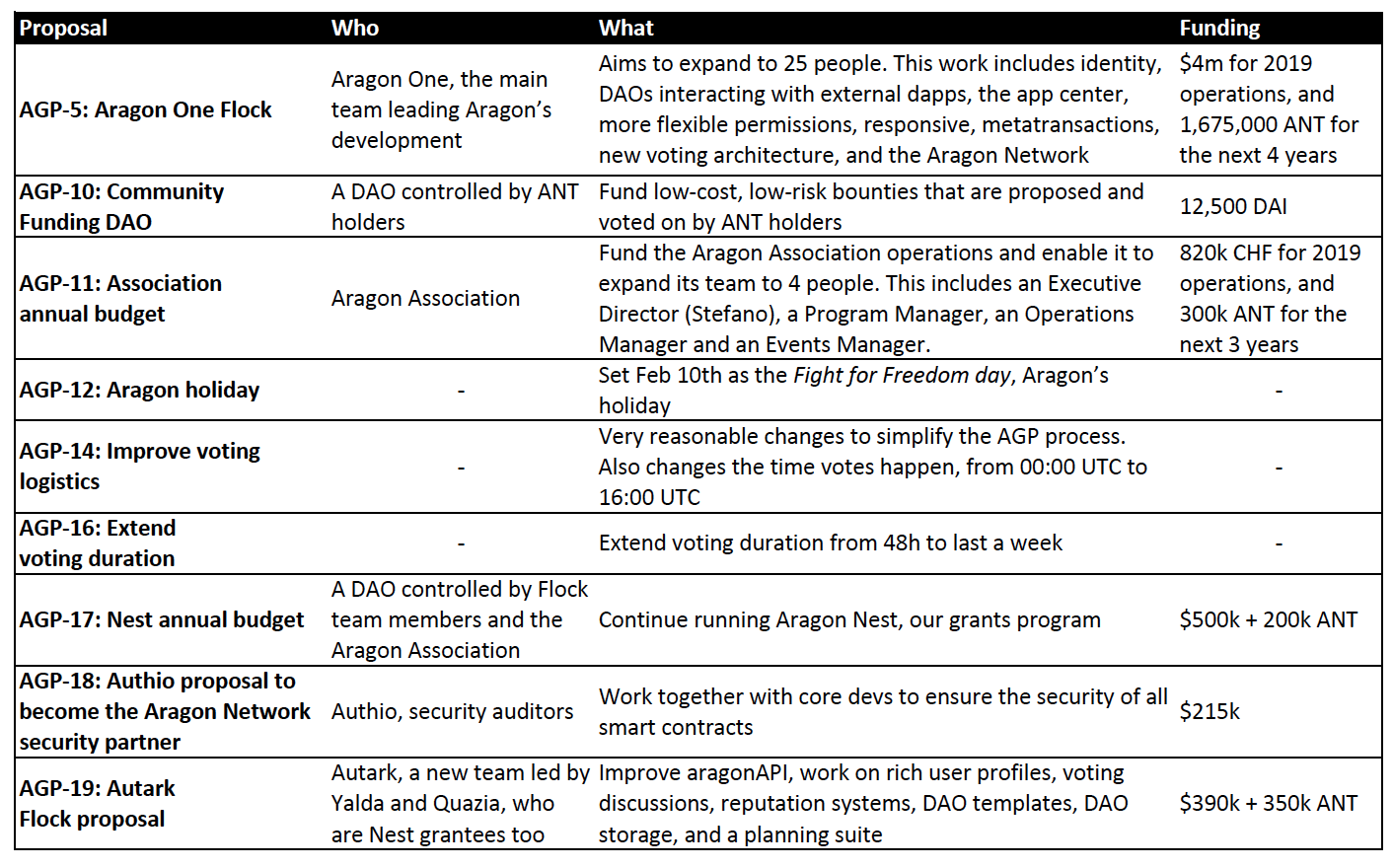

Finalized AGP proposals are due two weeks ahead of the network vote, which next takes place on January 24, 2019. The original deadline for AGP proposal submissions was January 3, but this date was pushed until January 10 in a vote. The Aragon Association then reviews proposals for pre-approval and includes the Association-approved proposals in the ballot.

The table below is a recap of Luis Cuende’s “Personal summary of AGP proposals for the Jan 24th, 2019 vote”

The Takeaway: As Aragon brilliantly described, “Decentralized Autonomous Organizations can do the same as what incandescent light bulbs did for humanity. Bring out the light among the darkness.” Ergo, DAOs enable completely new forms of governance.

Q&A with Alex Adelman, CEO & Co-founder of Lolli

Alex Adelman is the CEO & Co-founder of Lolli, a rewards application that lets people earn bitcoin when they shop online from 500+ top merchants. Alex was previously the CEO & Co-founder of Cosmic, the leading e-commerce gateway, which was acquired by PopSugar in ’15 and then by Ebates in ’17. Alex positioned Cosmic and Lolli as high growth, high value, and industry leading technology companies, establishing strategic partnerships with key partners in e-commerce. Alex was named to the Forbes 30 Under 30 list for Retail & E-Commerce. His work has been featured on WSJ, Forbes, Fortune, Wired, TechCrunch, Cheddar, MarketWatch, and Digiday and he’s presented at Advertising Week, Fashion Tech Forum, TechCrunch Disrupt, Tech Cocktail, Money 20/20, and Technori. Alex holds a BA in Economics from UNC-Chapel Hill.

Q: How did you get into Bitcoin?

A: My team and I were on a mission to democratize commerce with our last company, Cosmic. We built a universal e-commerce gateway that let people easily buy and sell their products in any channel. I was crashing on couches in NYC and was out with some friends one night when a guy started talking about bitcoin. We talked about it for hours. I became fascinated with it’s ability to give everyone the ability to use the same currency. The democratization of commerce, embedded in a digital currency. After several years, Cosmic was acquired by our biggest customer, PopSugar, and then again by Ebates, the leading cashback rewards company. The team and I parted ways with Ebates and set out on a mission to make bitcoin accessible to everyone through bitcoin rewards with Lolli.

Q: How is Lolli currently interacting with the Bitcoin blockchain?

A: We are currently buying, selling, and distributing bitcoin to users’ wallets when they shop at our 500+ merchant partners.

Q: Why does earning Bitcoin matter?

A: Bitcoin connects the world through commerce. It gives people the ability to be their own bank, to truly own their money. Bitcoin lets everyone be a part of the same financial ecosystem, regardless of who they are or where they live.

Earning bitcoin is extremely important as an easy, risk free onramp into bitcoin and for mass bitcoin adoption. Shopping is something that everyone does and Lolli makes it easy for people to earn bitcoin when they shop at 500+ merchant partners. Mining is not a realistic option for many people, as most people don’t have high-end computers to verify blockchain transactions. So most people have bought bitcoin through an exchange, and held onto it as an investment. Setting up an account with an exchange to invest in bitcoin isn’t easy either — a person must complete a multi-day or even multi-week process of verifying identity, going through an extensive background check, linking a bank account, and ultimately investing their money in a volatile asset. While investing has historically been the “easiest” way to get bitcoin, it’s still not that easy and can be risky. Lolli makes it easy to earn bitcoin by removing the need to invest and mine bitcoin to own it.

Q: Which categories of retailers have shown the most interest in Lolli?

A: Our users have been extremely interested in our travel, apparel, and essentials categories. Merchants like Walmart, Jet, Overstock, Priceline, and Hotwire have all done incredibly well on Lolli. Our users want to earn bitcoin on all their online purchases. We are partnering with new retailers every week and have a support team that can help our users find what they are looking for and the most bitcoin back across all our partners.

Q: Where do you see our industry in both 5 and 50 years?

A: I see bitcoin being a store of value for the next few years. I think some people will choose to use it as a currency but that will not be the primary use case for now. In 50 years, I see bitcoin, or something very similar, being both universal store of value, globally recognized currency, and credit system. The team and I are excited to help build that future.

That concludes the fifth issue of On-The-Chain. Feel free to reach out to me on Twitter. My DMs are always open.

A special thank you to Brian Flynn and Alex Adelman!

Nothing in this email is intended to serve as financial advice. Do your own research.